Skydance Media‘s $8 billion settlement to merge with Paramount International expired April 7 because the events await FCC approval. Underneath the phrases of the pact, the deadline for the settlement to shut has been mechanically prolonged for one more 90 days.

If by the top of that 90-day interval (July 7, 2025) the deal nonetheless hasn’t closed, it will likely be topic to a second 90-day extension. The automated extensions are triggered within the occasion that “all the situations of the closing, besides these regarding regulatory approvals, have been glad or waived,” per the businesses’ deal.

On July 7, 2024, after months of on-and-off negotiations, Paramount controlling shareholder Shari Redstone clinched a deal to merge the media conglomerate with Skydance.

The SEC authorized the Skydance-Paramount deal in February. That very same month, the European Fee gave it the thumbs-up, noting that the transaction doesn’t pose any vital anti-competitive considerations.

However the FCC has not but cleared the merger. And there’s no formal date by which the FCC should concern a call within the matter.

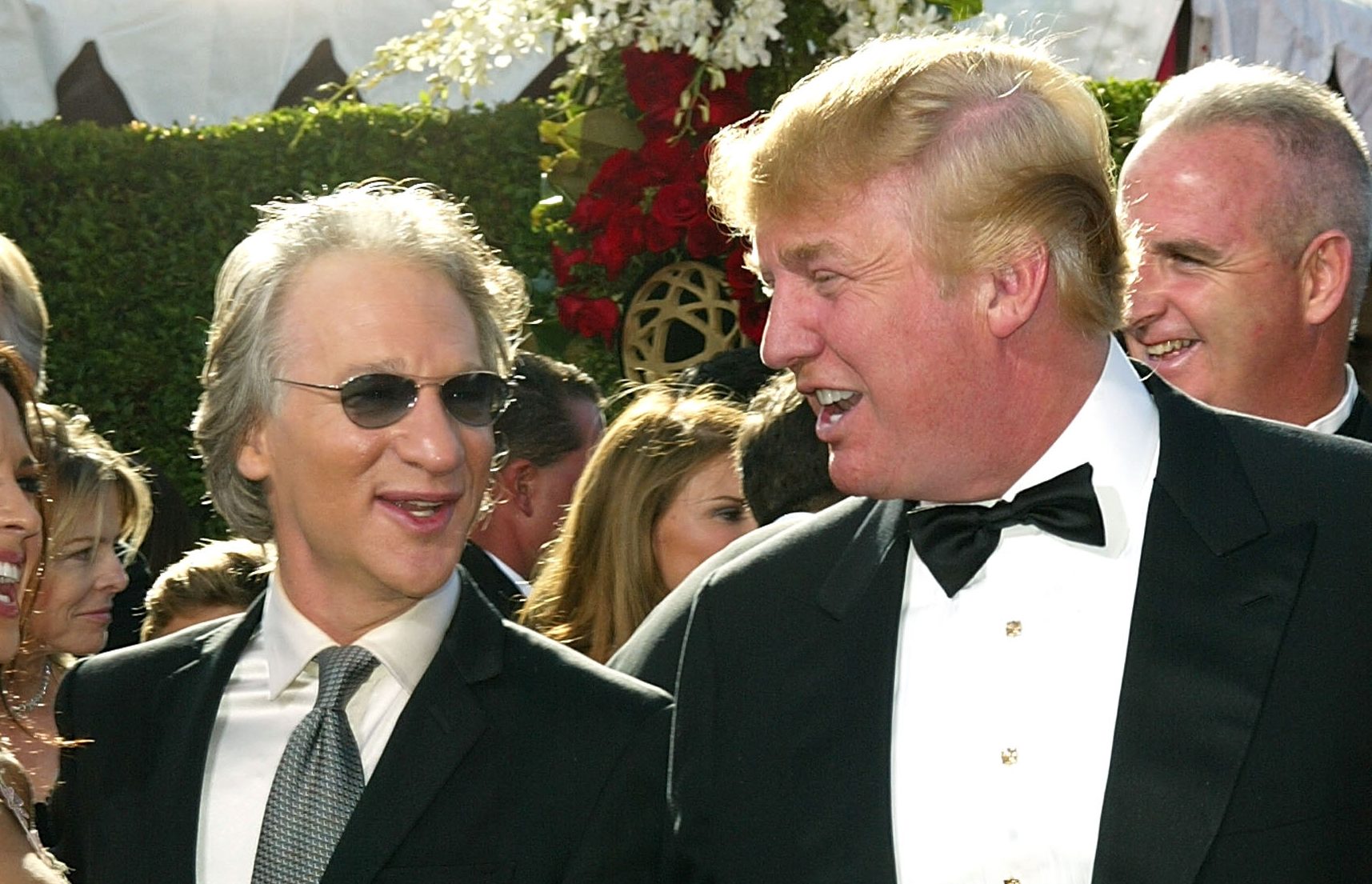

What’s the holdup? Some background on the scenario: Previous to the 2024 election, President Trump filed a lawsuit in opposition to CBS Information over a “60 Minutes” interview with Kamala Harris, alleged the Harris interview was deceptively edited. Trump has demanded $20 billion in damages. Final month, Paramount and CBS moved to dismiss Trump’s go well with as “an affront to the First Modification.”

Republican FCC Chairman Brendan Carr, a Trump appointee, has mentioned Trump’s “60 Minutes” lawsuit would probably can be an element in the course of the FCC’s evaluation of the Skydance-Paramount merger.

And final month, Carr claimed he’ll block M&A offers for media corporations that promote variety, fairness and inclusion packages — as he helps execute Trump’s aggressive anti-DEI agenda. Carr has directed the FCC to probe DEI practices as Disney/ABC and Comcast/NBCUniversal, claiming he’s involved the media corporations are selling “invidious types of DEI.” Paramount, in the meantime, in February mentioned it was altering a few of its DEI packages to adjust to the Trump administration’s directives.

The Skydance-Paramount deal has an enterprise worth estimated at $28 billion and provides Skydance an implied valuation of $4.75 billion. Shareholders of NAI will obtain $1.75 billion and the belief of NAI’s debt (for $2.4 billion complete enterprise worth) whereas Paramount International Class B frequent shareholders will obtain $15 per share. About $6 billion of the cash to fund the deal is coming from the Ellison household (i.e. Oracle founder Larry Ellison) and about $2 billion is from RedBird Capital Companions.

Final October, Skydance submitted an up to date submitting with the FCC to mirror that David Ellison, Skydance’s CEO, will maintain 100% p.c of the Ellison household’s voting pursuits within the newly mixed Skydance-Paramount and never Larry Ellison, as earlier paperwork indicated.

The post Skydance-Paramount Merger, Pending FCC OK, Will get 90-Day Extension appeared first on Allcelbrities.